Technical Analysis Basics: Moving Averages

February 3, 2010 | No Comments | Course

This article is part of the Trend Technician Technical Analysis Basics series. Be sure to read the rest of the series.

The most commonly used indicator by far is the moving average. Its value is easy to understand intuitively and one of the least controversial indicators. Almost any trader will agree to the value of moving averages.

Moving Average Basics

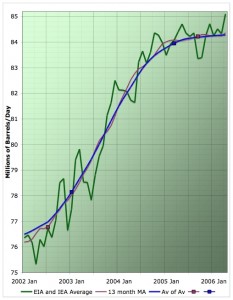

A moving average represents the average value of an issue over a trailing window. All moving averages are designated in terms of a time span for how many days of trailing data should be included in the average. For example, 10 day, 50 day and 200 day moving averages are commonly used. There are however several ways to calculate this average. The two most common are the simple moving average and the exponential moving average.

Simple Moving Average

The simple moving average is the most obvious type of moving average. For an X day moving average you simply total the values of the previous X days and divide by X. However, in addition to being simple, this method of calculation is somewhat volatile. The fact that all days are given an equal impact on the average leads to a high sensitivity to the value that has just dropped out of the window.

Exponential Moving Average

In an exponential moving average, or EMA the weight of each piece of data decays as it gets farther from the present. While much harder to calculate, these tend to give results that are less subject noise. The impact of each day decays exponentially as it gets farther from the present and thus the most recent data is the most influential.

Trading with Moving Averages

Using these moving averages is fairly straightforward. In general you want to be trading in the direction of the moving average, however there are some caveats:

When price has deviated particularly far from its moving average, there is a good chance it will return and “touch” the MA again. This deviation can be a good opportunity to take profits and re-enter the position when it returns to the moving average.

When a price crosses a moving average, this can indicate a change in trend direction. Many traders will use this as an indicator for a trend change.

Moving averages are integral to trading and are also pivotal in calculating other indicators. They are the basis of most numeric analysis of stocks and understanding them is very important.

Moving averages and chart analysis are the two most fundamental components of technical analysis. Even the most hardened technical analysis skeptic will admit that a moving average has its uses. Being able to read a chart is a key skill and moving averages can help provide an objective piece of insight to the process. Understanding moving averages begins with understanding the different types of indicators available.

Moving averages and chart analysis are the two most fundamental components of technical analysis. Even the most hardened technical analysis skeptic will admit that a moving average has its uses. Being able to read a chart is a key skill and moving averages can help provide an objective piece of insight to the process. Understanding moving averages begins with understanding the different types of indicators available.