Natural gas is a tricky trade. While market psychology plays a huge role even in commodity trades, the price is in the throes of some serious fundamental impacts. The price skyrocketed to reach spectacular highs in 2008 and has plummeted since. Even as it has declined, it’s been a popular buy by some as evidenced by the fact that the UNG ETF has run out of shares until regulators approve more.

When it comes to natural gas, the ETF can provide an easy way to trade the underlying commodity. I’m not interested in getting a futures trading account, so the fund works well enough for me. More importantly however, looking at the trailing 12 months or so in this fund can provide a couple of excellent lessons. First let’s watch some analysis:

Now if you watched that video the first thing I think you can see is this: Don’t trade against the monthly trend. You don’t have to trade with the monthly trend, but you definitely don’t want to trade against it. The other lesson, which is just as important, is: Money management is more important than being right.

If you look at the examples in question, the Trade Triangle system produced 9 trades in that time period, 5 were winners and 4 were losers. So that’s right around 50% results. The difference is, the losers were tiny and the winners were huge. That’s your goal as a trader. You need to accept right now that you are going to be wrong. Trading is about probabilities and putting them all in your favor. That’s why I wrote about setting a “stop” point for any trade you enter. If your losers are small and your winners are big then you will make a fortune. You don’t even have to be right half the time, if you can make your wins big enough.

As for right now, my interpretation is that the overall trend is still downward, but that the moderate term has turned up. I would basically say this means “hands off.” I’d wait for some real signs of an up-side breakout before I went long in this fund. Of course that’s strictly on a technical basis, for all we know the government may mandate CNG cars soon and UNG will go to 100. If you want to keep up with UNG, you can get a free trend analysis here, which will give you an idea of whether it’s turned or not.

Free Trend Analysis of UNG ETF

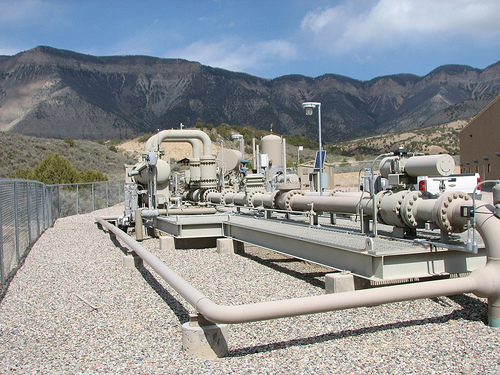

Photo Credit: EnergyTomorrow

Great post! I’ve been following UNG since February and I’m very excited about this stock. Great analysis all around.

you basically said maybe we should buy ung and maybe we shouldn’t. wow- you should be writing for rocket science daily.

@a,

If you’re looking for a blog to give you explicit buy or sell recommendations then I’d suggest you look elsewhere than on the Internet. The best advice is presenting the pros and cons of a given investment you might be considering. If you think trading is ever black and white, then you’re way ahead of me. The whole point of the article was that you don’t have to always be right to make money if you practice good money management, not whether UNG is a buy right this very second.